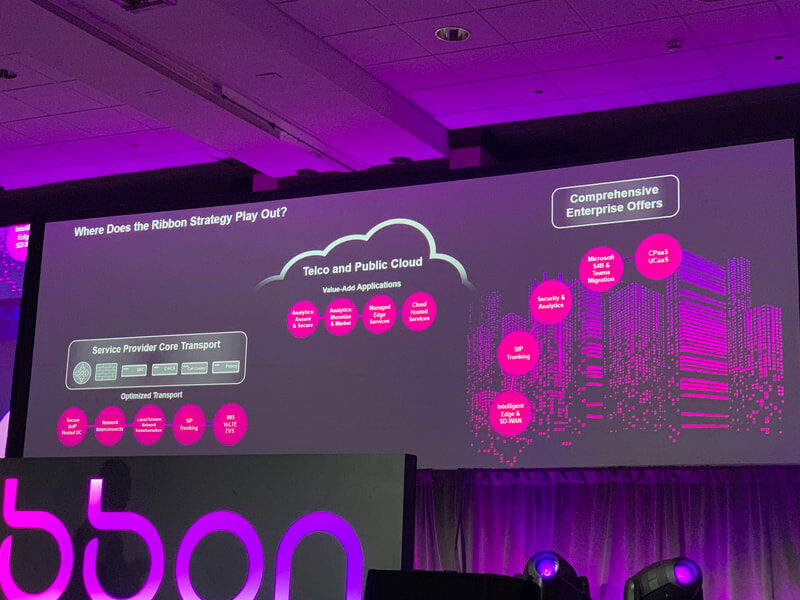

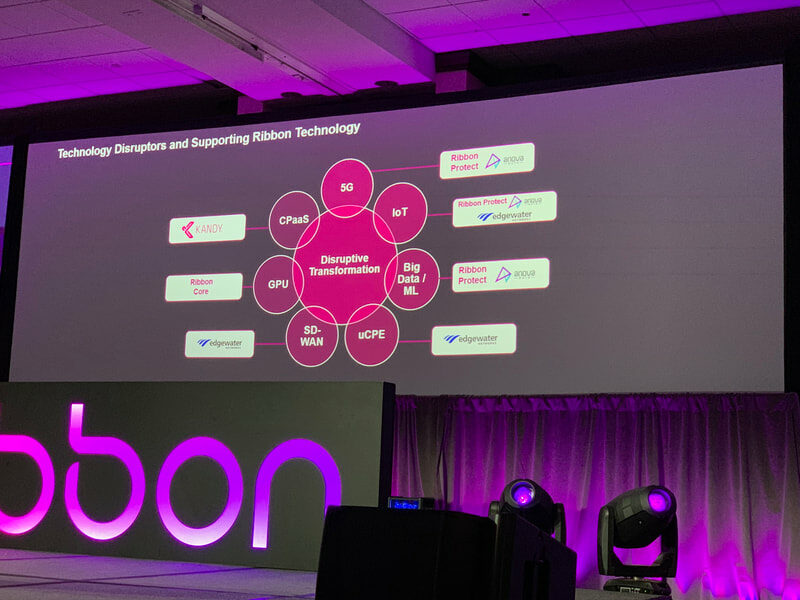

The main message of Ribbon keynotes was that Ribbon has moved from a voice and SBC focus to a broader scope including data and analytics, such as UCaaS, Security-as-a-Service, Service Assurance-as-a-Service, SIP Trunking-as-a-Service, SD-WAN, and analytics. The company identified two major catalysts to the change in company scope: the August 2018 acquisition of enterprise SBC company Edgewater and the February 2019 acquisition of analytics company, anova. Additionally, the company confirmed that it is not pursuing service provider mobile market opportunities such as EPC or “full IMS” that are components of larget mobile equipment larger vendors. Instead, Ribbon is pursuing the mobile market by offering overlay analytics services that allow SP customers to derive value from mobile operators using monetization, network, marketing, and customer care.

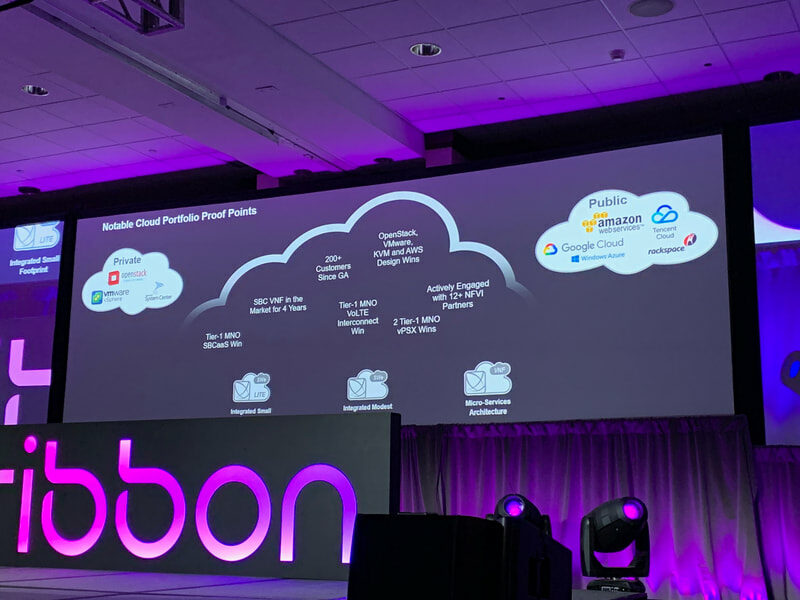

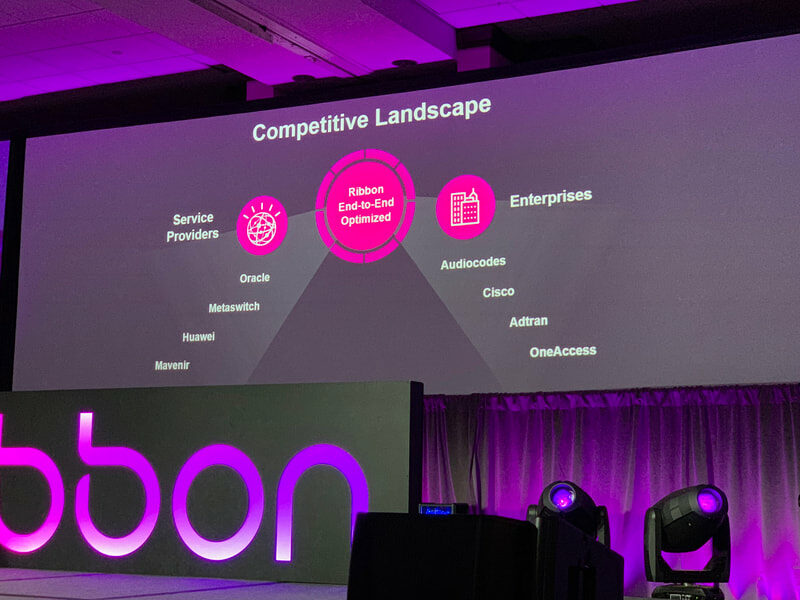

The company’s core business is evolving. For instance, the company has doubled down on the Enterprise market with its Edgewater acquisition, and a result, it emphasized that it is unique because it has both service provider and enterprise SBC product offerings. The company has offered SBC on public cloud and reiterated that this capability has been available for one year. The company highlighted that it has a Tier-1 Mobile Network Operator VoLTE Interconnect contract win.

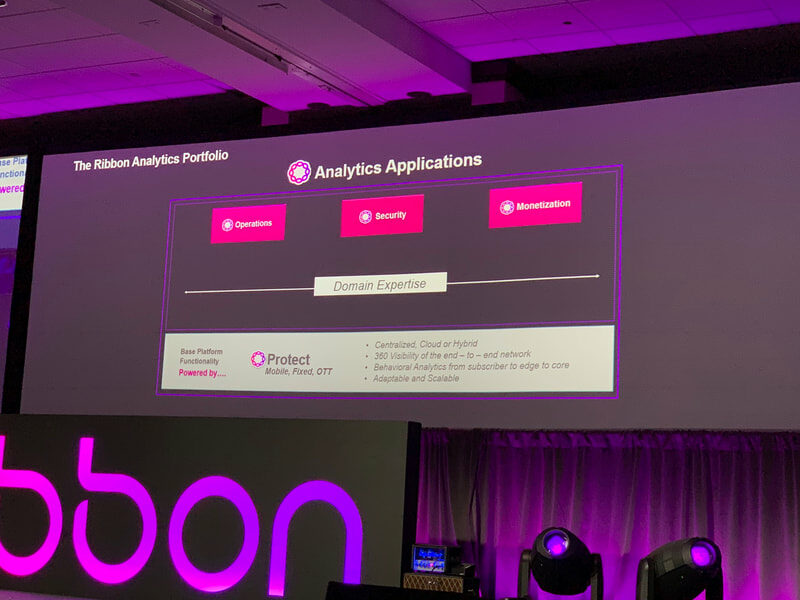

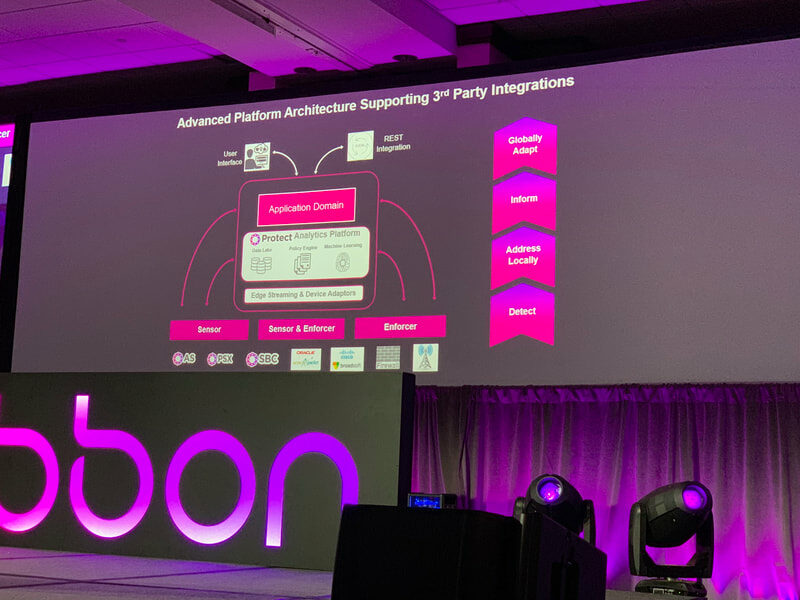

Analytics. The company sees its opportunity in the analytics market is to deliver technology to the customer for the following cases:

• Monetization (Targeting, Advertising, Sponsored Data, Campaign Efficacy)

• Network (Reduce Network Cost, Improved Quality of Experience, Proactive Alarms, Network Service Assurance)

• Marketing (Service bundles, churn reduction, product insights, inferred demographics)

• Customer Care (customer experience, bill shock, most probably cause)

We are impressed with Ribbon’s technical capabilities when it comes to using GPUs. The company has previously discussed the performance of its GPU based media interworking function as being 3.5x more powerful than a DSP-based system, or 9x more powerful than a CPU-based system and over 2x more power efficient. The company says its GPU-based systems are generally available for its D-SBC and i-SBC functions. It has evaluations at three operators: Tier-1 US MNO, Tier-1 US CSP, and Tier-1 Japan CSP. We would not be surprised if some of these customers begin deploying soon. One of its Tier-1 operators found that the GPU-based system costs half as much in capital spending and is 800% more power efficient.

Kandy, the white-label voice/messaging services brand of Ribbon discussed its success with customers such as BT, NUWAVE, AT&T, Hong Kong Broadband, Optus, and ecosystem partner, Five9. It enables UCaaS, CPaaS and WebRTC services. The company reiterated that it plans to go to market with partners, mainly service providers, instead of opening its own store-front that would compete with service providers. The company says its customer pipeline is growing.